WARNING! WIRE FRAUD ON THE RISE! ALWAYS VERBALLY CONFIRM WIRE INSTRUCTIONS RECEIVED VIA EMAIL!12/12/2017 At SSB law we have implemented strong and vigilant internal protection techniques to prevent hacking and wire fraud. We verbally confirm all wire instructions received via fax or email. And to err on the side of caution, our IT department has taken steps to ensure our outgoing email is secure and protected against being hacked.

1 Comment

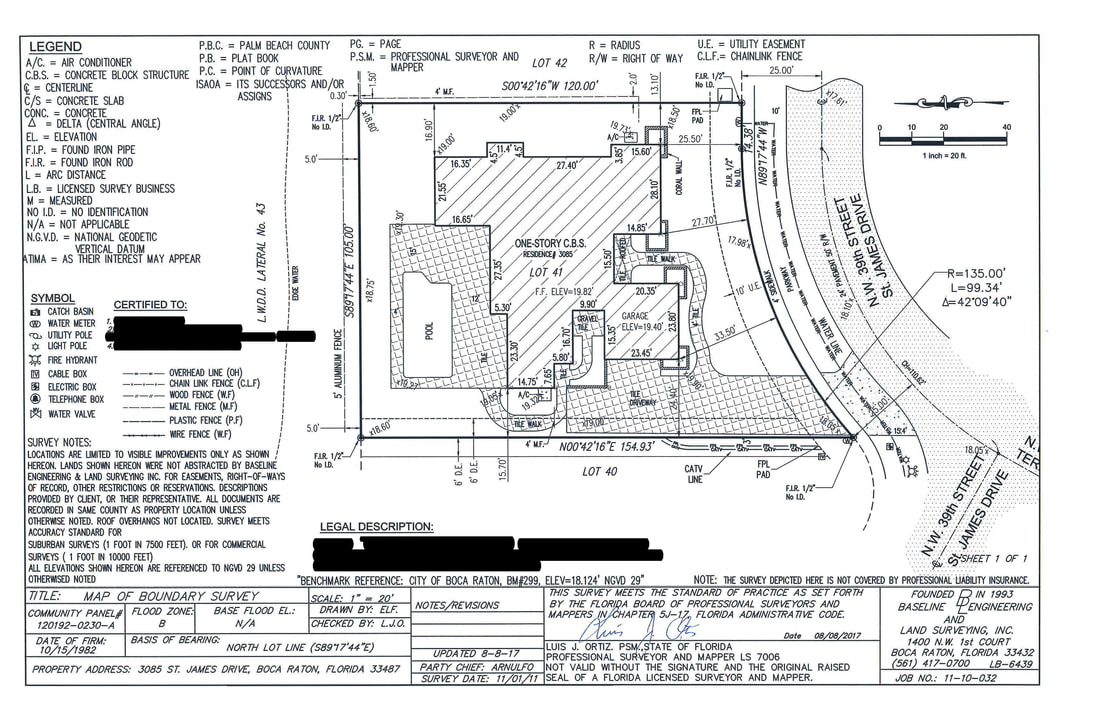

First let us start with the basics - what is a boundary survey? A boundary survey is, in the most basic of terms, a drawing, map of the property showing precisely where the house lies within the boundary lines, the patio and/or additions as well as the locations easements and/or encroachments, if any. The survey will confirm the legal description of the property, disclose any encroachments, easements or rights of way (drainage easements, sewer easements, etc) and pinpoint locations of fences, driveways, and other relevant information pertaining to the property being purchased. A common type of encroachment is a utility easement running through a driveway or rear of the property given to the local utility agency for maintenance of water lines, sewer lines, cable, etc. The survey also confirms legal access (ingress/egress) to the property. Lenders, in literal terms, do not require a survey. Yes, that is true. Lenders do however, require that the title agent issuing the lender's title policy delete the survey exception which is a standard exception on all title policies and provide a Florida Form 9 / ALTA 9 endorsement to the lender's title policy issued at the closing of the loan. Lenders are in need of more comprehensive title insurance coverage and require affirmative coverage over any matters shown on the survey that could interfere with their secured interest (the property). Such matters are protected by the issuance of the ALTA 9 endorsement. Examples of which include coverage for loss due to incorrectness of assurance that certain matters do not exist (violations of zoning laws), violations of platted setback lines, encroachments, encroachments of improvements onto easements, etc. In simple terms, should an encroachment or setback pose issue and compromise the integrity of the lender's interest in the secured property, the endorsement will allow for the lender to make a title insurance claim to protect their interest. Without the endorsement, the lender is subject to loss of part or some of their secured collateral (the property) due to an encroachment or setback violation, etc. Even in cash transactions, a survey should always be purchased by the buyer because it provides assurances to the buyer for a variety of matters. It allows the buyer to determine if there are any title matters disclosed on a survey that render the title unmarketable, confirms that boundary lines and legal descriptions, and provides notice of any encroachments onto the property by way of easements or other rights of way that will interfere with your property lines. For example an easement in the rear of your property for a utility company that is 5 feet into your property line will prevent you from putting up a fence at the edge of your property line and require the fence be 6 feet from the property line. It helps you discover that the fence line is not the true property line. Below is an example of a survey which shows a 6 foot easement along the western boundary line; 10 foot utility easement running through the driveway and the fence not actually within the boundary lines of the property (in the rear).

Categories All |

RSS Feed

RSS Feed