|

Why do I need title insurance?

I cannot even tell you how many times that I have been asked that question. The truth is most people don't know what title insurance is and I do not blame them, I did not know what it was when I bought my first home! So we have summed up exactly what is title insurance and why you need it in a few succinct points: Title insurance is NOT casualty insurance. Title insurance protects the new owner (and lender, if any) from any liens, encumbrances, or claims against the property that originated prior to their ownership. For example: A buys a home from B and B had a home equity line of credit. B was a bad boy. B withdrew the entire line of credit the day of closing! Now A has a valid and enforceable mortgage against A's new home. But A was smart and purchased an owner's title insurance policy which now protects A's interest in the home and is liable for the balance of the equity line of credit. Another example: A sells his primary residence aka homestead to B. A is married but A's spouse did not sign the deed. Florida law requires spousal joinder on conveyance of homestead property. So now B's title (deed) is defective. B must now place a claim with his title insurance policy to secure a corrective deed so that B can sell or mortgage/encumber the property as B wishes. Title insurance protects your equity in your home up to the full amount of the price for which the home was purchased. Title insurance is absolutely necessary. Spend a few dollars now to save a lot of dollars later.

1 Comment

Plan on Buying Properties at the Foreclosure Auction? A Checklist is a Great Place to Start.Although the checklist below is by no means comprehensive, it is a good start. Buying at the foreclosure auction is a risky business! With the right knowledge and diligence, buying a property at the foreclosure auction riddled with title defects can be avoided. Schedule an appointment with our title defect specialist, Jordana Sarrell, Esq., LL.M., to discuss the benefits and downfalls of foreclosure properties and how to protect your interest and money!

Want to know what you do if a problem arises when going through these checklist items? It is essential to conduct a full and thorough search behind and through the foreclosure to safeguard against buying problematic or defective title at the foreclosure auction. A real estate attorney should be consulted for guidance and advice. The checklist above is NOT a comprehensive checklist and is not intended to serve as a guide to buying property at the foreclosure sales. The checklist is for informational purposes only. For a more thorough and detailed analysis and checklist, contact SSB LAW today! Inactive. Expired. Open. These three verbs when associated with municipal or county permits in a residential real estate transaction can send a buyer, seller, real estate agent or title company into a frenzy. But what is really the responsibility of parties in an AS IS residential real estate transaction with respect to permits?

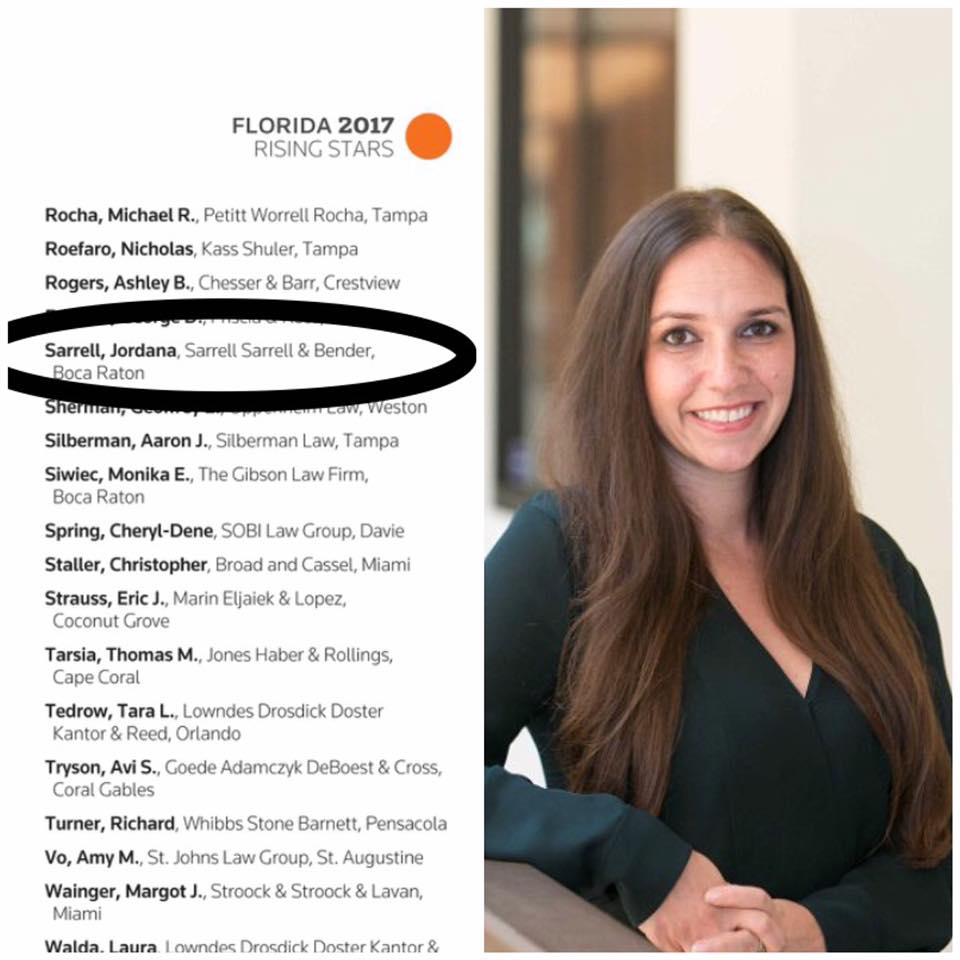

Most people operate under the presumption that permits are a title issue or in other words covered under a title policy. This is simply untrue. Rather the opposite is true, inactive/open/expired permits are specifically excluded from title insurance policy jackets. So, any inactive/expired/open permits are not covered under your title policy should an issue arise and the title agent is not under any obligation to ensure that they are dealt with. The standard FARBAR AS IS contract specifically places the onus on the buyer to make an inquiry as to whether there are any inactive/open/expired municipal or county permitsduring the inspection period. What does this mean? It means that if the buyer doesn't conduct a permit inquiry during the inspection period, any inactive/open/expired permits are not required to be closed to finalized the sale. Moreover, if the buyer discovers inactive/open/expired permits, within the inspection period, the seller is only required to facilitate the closing of those permits and not required to spend any money in the process. Permits, when not dealt with, however, in some situations amount to a greater problem such as a municipal or county code violation leading to monetary fines. So a prudent real estate attorney representing a buyer will ensure that the contract specifically includes language requiring any inactive/open/expired permits be closed at the seller's sole expense. Or a seller's attorney will leave the contract in its current form as it benefits the seller. It is always important to have a real estate attorney with you every step of the way from negotiating a contract through closing to ensure you are completely protected. After all buying real estate will likely be the biggest and most important purchase of your life! Managing attorney, Jordana Stern Sarrell, Esq., LL.M., has been awarded the distinct honor of being chosen as a Florida Super Lawyer Rising Star in the area of Real Estate Law for the second year in a row.

Same Sex Marriage & Real EstateIn January 2015 the Supreme Court of the United States issued an historic and groundbreaking ruling in Obergefell v. Hodges which held that the fundamental right to marry is guaranteed to same-sex couples by both the due process and equal protection clauses of the fourteenth amendment of the U.S. Constitution. So what does this mean with respect to real estate in Florida? Well…

|

RSS Feed

RSS Feed