|

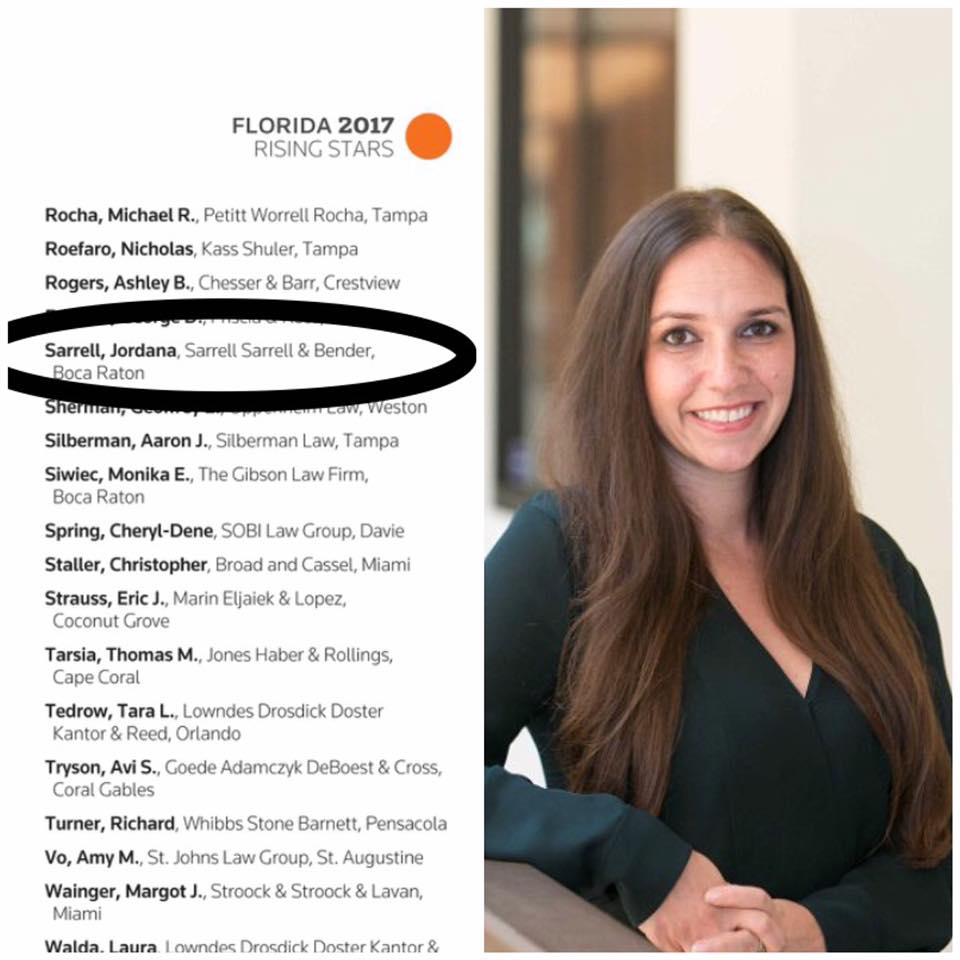

Managing attorney, Jordana Stern Sarrell, Esq., LL.M., has been awarded the distinct honor of being chosen as a Florida Super Lawyer Rising Star in the area of Real Estate Law for the second year in a row.

2 Comments

Same Sex Marriage & Real EstateIn January 2015 the Supreme Court of the United States issued an historic and groundbreaking ruling in Obergefell v. Hodges which held that the fundamental right to marry is guaranteed to same-sex couples by both the due process and equal protection clauses of the fourteenth amendment of the U.S. Constitution. So what does this mean with respect to real estate in Florida? Well…

|

RSS Feed

RSS Feed